Loans

Educational Loans

Student loans are the most common form of financial assistance for law students. Students can use loans not just for tuition and fees but also cover or assist in indirect expenses such as books & supplies, rent & utilities, transportation, and other personal expenses.

If you are using student loans to pay for law school, remember that loans do need to be paid back and the interest on law school loans begins to accrue as soon as the loans disburse to your Detroit Mercy student account. Create a budget and stick to it. Living like a lawyer now may mean living like a student later.

US Federal Loans

-

Federal Financial Aid Process

In order to receive federal financial aid, there are a few steps you must complete.

- Complete the Free Application for Federal Student Aid (FAFSA) as early as October 1st for the following year's aid.

- Detroit Mercy Law Federal Code: 002323

- University of Windsor Federal Code (for dual degree students): G06689

- Receive and Review your Student Aid Report (SAR)

- If you provided an email address on your FAFSA, you will receive this via email. If you don't see it check your SPAM/Junk folder.

- Carefully review the information on the SAR and follow the directions for making corrections, if required.

- Students must be enrolled at least half-time to be eligible for federal student loans. Half-time at Detroit Mercy School of Law depends on the term:

- Fall Term - Minimum credit requirement is 6 credits

- Winter Term - Minimum credit requirement is 6 credits

- Summer Term - Minimum credit requirement is 3 credits (credits may be in summer intersession and/or standard summer session)

- Receive and Review Your Award Notification on My Portal --> Student Profile --> Financial Aid --> Financial Aid Award

- You can "accept", "decline", or "modify" the amount of federal aid offered.

- Complete Additional Federal Student Loan Requirements at studentaid.gov

- Entrance Counseling:

- If you have not previously received federal student loans at Detroit Mercy at the graduate level, the Federal government requires you to complete entrance counseling to ensure that you understand the responsibilities and obligations you are assuming.

- If you have previously received federal student loans but have not received them at Detroit Mercy Law, we encourage students to complete the counseling again. Terms may have changed since you last completed this

- PLUS Credit Counseling

- PLUS credit counseling is required if the U.S. Department of Education has informed you that you have adverse credit history and you have either obtained an endorser or documented extenuating circumstances to the satisfaction of the U.S. Department of Education.

- Master Promissory Note (MPN)

- The Master Promissory Note is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

- There are separate loan agreements for the Direct Unsubsidized Loan and for the Graduate PLUS loan. If you think you will be taking out both, please do both.

- Entrance Counseling:

- Request for Additional Information

- Some applications require that additional information be submitted and reviewed before it is complete. Please respond promptly to all requests.

- Complete the Free Application for Federal Student Aid (FAFSA) as early as October 1st for the following year's aid.

-

FAFSA Best Practices

- Make sure you have your FSA ID and password ready

- You should do your FAFSA; your parents should not be doing it for you nor should anyone else

- Question: What college degree or certificate will you be working on when you begin the 2025-26 school year?

- Answer: College graduate/professional degree

- Question: What will your college grade level be when you begin the 2025-26 school year?

- Answer: Continuing graduate/professional or beyond

- University of Detroit Mercy Federal School Code is 002323

- If possible, use the IRS retrieval tool to transfer your tax data

- You are an Independent Student for US Federal Financial Aid

- Detroit Mercy Law does not require you to input parental tax information

- When you get your Student Aid Report (SAR), check to see if you need to make any corrections. If you have any comments that indicate a correction is needed, make those corrections right away.

-

Direct Unsubsidized Loan

Federal Direct Unsubsidized Loans are long-term, low-interest education loans. This is the most common federal loan. While these loans do not require a credit check, you must not be in default on any federal loan programs nor owe funds to any Federal grant programs.

Interest Rate: This loan is an unsubsidized loan meaning that the loan will begin accruing interest as soon as it disburses to your Detroit Mercy account:

- Disbursing July 1, 2025-June 30, 2026 – 7.94% fixed for the lifetime of the loan

Maximum Annual Amount: The maximum annual amount for the Direct Unsubsidized Loan is $20,500 during the academic year. Students enrolling in summer coursework may qualify for additional Direct Unsubsidized funds.

Origination Fee: Federal student loans have a loan fee that is a percentage of the total loan amount. The loan fee is deducted proportionally from each loan disbursement you receive. Therefore, the net result disbursed is less than the loan amount approved,

- For loans with a first disbursement on or after October 1, 2020, an origination fee of 1.057% is deducted automatically from amounts borrowed on these loans.

Repayment start date: Repayment beings 6 months after you graduate or you cease to be enrolled at least half-time.

-

Graduate PLUS Loan

Federal Direct Graduate PLUS Loans are long-term, low-interest education loans. The PLUS loan is a credit-based loan, but students with adverse credit may still be eligible if they appeal their credit and/or have an endorser.

Interest Rate: This loan is an unsubsidized loan meaning that the loan will begin accruing interest as soon as it disburses to your Detroit Mercy account.

- Disbursing July 1, 2025-June 30, 2026 - 8.94% fixed for the lifetime of the loan

Maximum Annual Amount: The PLUS does not have any annual borrowing maximums, so this loan may be used to bridge the gap between all other forms of funding and aid, and your total cost of attendance.

Origination Fee: A loan origination fee is an upfront fee charged by a lender for processing the loan. The loan origination fee is deducted automatically from amounts borrowed from these loans prior to the fund disbursing to your Detroit Mercy student account. Therefore, the net result disbursed is less than the loan amount approved.

- For PLUS loans disbursed on or after October 1, 2020, the loan origination fee is 4.228%

Repayment start date: PLUS graduate loans enter repayment once the loan is fully disbursed. However, as a graduate student, your loan will be placed into deferment while you are enrolled at least half-time and for an additional six months after you cease to be enrolled at least half-time.

-

Comparison of Federal Student Loans

Students often take out both the Direct Unsubsidized Loan and the Graduate PLUS Loan. But we always start with the Direct Unsubsidized Loan as it has more favorable terms as shown in the table below.

Direct Unsubsidized Loan and the Graduate PLUS Loan Terms Direct Unsubsidized Loan Graduate PLUS Loan Annual Limit* $20,500 Up to the cost of attendance minus other aid

Aggregate Limit $138,500 (The aggregate limit includes all federal loans received while in graduate and undergraduate study.) There is no aggregate limit. 2025-26 Interest Rate** 7.94% 8.94% Loan Origination Fee*** 1.057% 4.228% Accruing interest while in school Yes Yes Credit Check Requirement No Yes Endorser/Cosigner required No Sometimes, depending on credit history Repayment/Grace period 6 month grace period (no payments are required) after you graduate, leave school, or drop below half time (at Detroit Mercy half-time is 6-credits in fall & winter and 3-credits in summer). There is no grace period but you’ll automatically get a six-month “deferment” after you graduate, leave school, or drop below half-time. No payments are required during the 6 month deferment period.

*For Financial Aid purposes at Detroit Mercy, an annual year is considered two consecutive semesters.

**Congress sets the yearly interest rates (July 1 – June 31) based on the 10-year Treasury note. This is typically set between May 1 and June 1 each year.

**The origination fee is the processing fee that the Federal Department of Education deducts from your loan prior to disbursing the funds to the College/University.

-

Withdrawal and Return of Title IV Funds (R2T4) Policy

Federal Financial Aid (Title IV Funds) is awarded to a student under the assumption that the student will attend school for the entire period of enrollment for which the aid is awarded. The term “Title IV Funds” refers to the Federal Financial Aid programs authorized under the Higher Education Act of 1965 (as amended) and includes the following programs:

- Direct Unsubsidized Loans

- Direct Graduate PLUS Loans

Federal regulations require schools to calculate how much Federal Financial Aid a student has earned if that student withdraws in one of the following ways:

- Completely withdraws

- Stops attending before completing the semester

- Receives all non-passing grades in a semester, including but not limited to F, XF, I, W, FNC, INC, WNC, NR, I/F

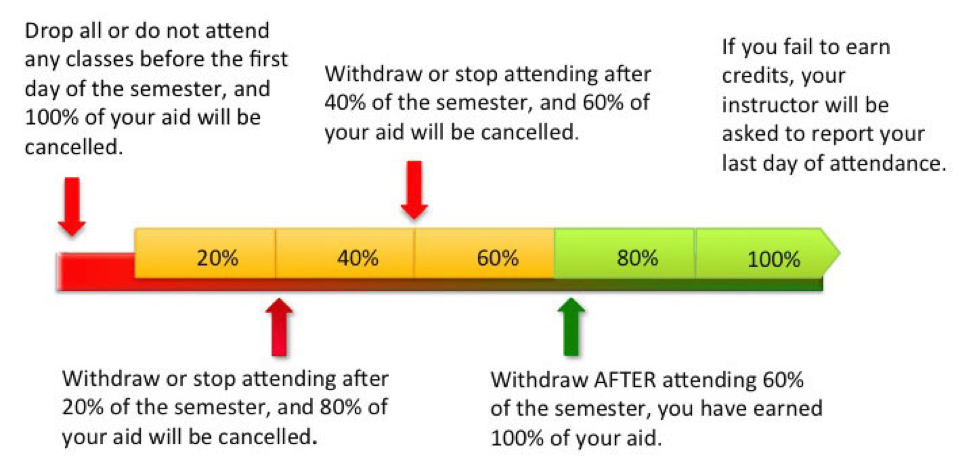

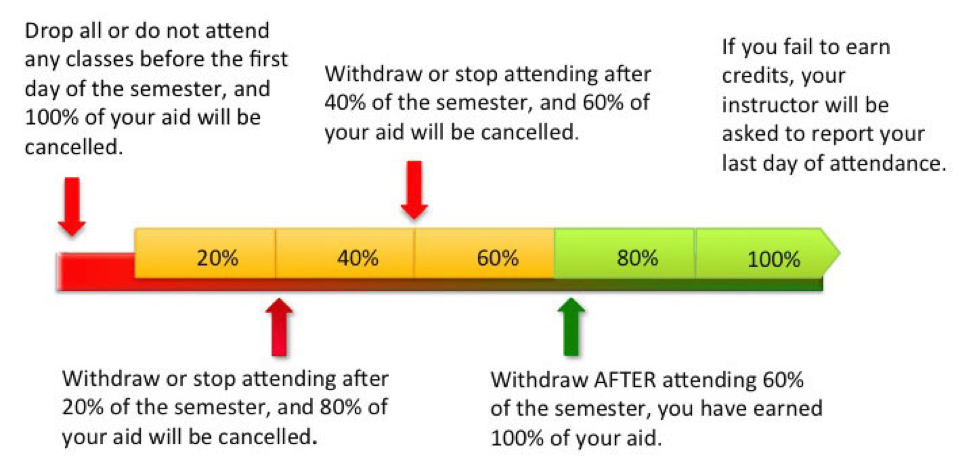

When a Title IV recipient withdraws from or ceases attending all of their classes prior to completion of 60% of the period of enrollment, federal regulations require a recalculation of any Title IV funds disbursed during that period of enrollment. The period of enrollment includes all calendar days of the semester, excluding any scheduled breaks (ex. spring break). A federally mandated formula is used to determine the amount of federal funds the student has earned based on the number of days the student actually attended.

For example, if a student attends 20% of the semester they are considered to have earned 20% of the Title IV funds they are entitled to and 80% is required to be returned to the government. If a student completes 60% or more of the semester they are considered to have earned all of their federal aid and will not be required to return any funds.

-

Calendar for Disbursement of Loans

If a student loan borrower has completed all of the necessary requirements (i.e. correct credit enrollment, completed entrance counseling, signed master promissory notes) Federal loans are disbursed into students' tuition accounts approximately 10 days prior to the start of classes each semester. After tuition is paid, any balance is refunded back to the borrower.

Canadian Loans

-

Provincial Canadian Loans

Canadian citizens and other qualified residents may be able to obtain a Canadian student loan to attend Detroit Mercy. Each province has its own requirements. Depending upon the province’s own resources, a student may receive just the federal portion of their student loan eligibility or that portion supplemented by funds from the province itself. Students applying for Canadian student loans should apply through the province in which they have established residency.

Canadian students wishing to have their loan applications and related materials certified should bring their application forms to the Financial Aid Office in the Student Service Center for completion. The Financial Aid staff will complete and mail the applications as well as fax them to any offices that accept faxed documents.

- Alberta Student Aid

- British Columbia Student Aid

- Manitoba Student Aid

- New Brunswick Student Financial Services

- Newfoundland and Labrador Student Financial Services

- Northwest Territories Student Financial Assistance

- Nova Scotia Student Assistance

- Nunavut Student Funding

- Ontario Student Assistance Program (OSAP)

- Prince Edward Island Student Financial Services

- Quebec Student Financial Aid

- Saskatchewan Student Loans

- Yukon Student Financial Assistance

-

Canadian Student Line of Credit

A line of credit is a type of loan that allows you to borrow funds repeatedly up to a pre-set limit. You can borrow money from a line of credit, pay it back, and then borrow again, up to your credit limit. Canadian citizens studying at Detroit Mercy Law typically only use a line of credit when they have reached their annual or aggregate borrowing limits through their province or territory.

Many Canadian banks offer a line of credit specifically for students. Interest rates are approximately equal to the prime rate, with some banks offering lower rates.

Private Educational Loans

-

Private Loan Search

After reviewing the terms and amounts of federal loans, students may want to consider credit-based private educational loans to help pay for direct and indirect college expenses. Private educational loans are based on an individual's credit rating and some do require a cosigner. Lenders often have different variable and fixed interest rates, repayment schedules, and loan approval criteria. But if you have good credit, the interest rate will likely be less than the federal PLUS loan interest rate and some lenders offer interest rate reductions, principal reductions, or other borrower benefits that may reduce the cost of the loan.

Comparing the various loans can seem overwhelming, therefore the University has an excellent tool, ELMSelect, that helps students compare a few private lenders who have been reviewed by a University-wide committee. This comparison tool assists students in the information gathering process.

This list is not exhaustive. You are not required to borrow from one of the lenders listed here. We acknowledge that you may be offered more favorable terms from lenders you find elsewhere. You may choose to borrow from any lender without penalty.

-

Private Educational Loan Disclosures

In accordance with 34 CFR 668.14(b)(29)(ii), an institution must, upon the request of the applicant, discuss the availability of Federal, State, and institutional financial aid. Financial aid advisors in University of Detroit Mercy's Scholarship and Financial Office are happy to discuss with students and prospective students, and their parents, the financial aid options available to them. Students and parents may qualify for loans or other assistance under Title IV of the Higher Education Act programs. The terms and conditions of Title IV HEA program loans may be more favorable than the provisions of private educational loans.

The Higher Education Opportunity Act of 2008 (Pub. L. 110-35) (HEOA) added section 128(e)(3) to the TILA to require that before a private educational lender may consummate a private education loan for a student in attendance at an institution of higher education, the private education lender must obtain the completed and signed Self-Certification Form from the applicant. The Federal Reserve Board’s Final Regulations published on August 14, 2009 incorporate this new requirement at 12 CFR 226.48(e). Many lenders of private loans will provide the Self-Certification Form to the student borrower. The form is also available below:

-

Comparison of Federal Loans and Private Loans

Federal student loans are made by the government, with terms and conditions that are set by law, and include many benefits (such as fixed interest rates and income-driven repayment plans) not typically offered with private loans.

In contrast, private loans are made by private organizations such as banks, credit unions, and state-based or state-affiliated organizations, and have terms and conditions that are set by the lender. Private student loans are generally more expensive than federal student loans.

The chart below provides a summary of the differences.

Federal Loans vs. Private Loans Subject Federal Student Loans Private Student Loans When payments become due Payments aren’t due until after you graduate, leave school, or change your enrollment status to less than half-time. Many private student loans require payments while you are still in school, but some do allow you to defer (put off) payments while in school. Interest rates The interest rate is fixed and is often lower than private loans—and much lower than some credit card interest rates. Private student loans can have variable or fixed interest rates, which may be higher or lower than the rates on federal loans depending on your circumstances. Credit check You only need to get a credit check for the Graduate PLUS loan. For PLUS loans, the Department of Education will check credit before determining eligibility. Learn how someone with an adverse credit history may qualify for a PLUS loan. Private student loans often require an established credit record or a cosigner. Tax benefits Interest may be tax-deductible. Interest may be tax-deductible. Consolidation and refinancing Loans can be consolidated into a Direct Consolidation Loan.Private student loans cannot be consolidated into a Direct Consolidation Loan but may be refinanced.Postponement optionsIf you are having trouble repaying your loan, you may be able to temporarily postpone or lower your payments.You should check with your lender to find out about options for postponing or lowering your loan payments.Repayment plansYou should check with your lender to find out about your repayment options.Prepayment penaltiesThere is no prepayment penalty fee.You need to make sure there are no prepayment penalty fees.Loan forgivenessYou may be eligible to have some portion of your loans forgiven if you work in public service. Learn about federal loan forgiveness programs.Most private lenders do not offer loan forgiveness programs.